What is a Value Bet and How Do They Work?

Value betting is the key to long-term success in sports betting. This guide explains what a value bet is, how to calculate expected value, and why consistently betting with an edge leads to profit.

With clear examples and simple math, you'll understand exactly how value betting works and how to apply it using Fair Odds Terminal.

What is a Value Bet?

A value bet occurs when the odds offered by a bookmaker are higher than the true probability of the outcome.

In other words:

You're getting paid more than you should for the risk you're taking.

This is the fundamental concept that separates professional bettors from recreational gamblers.

[ IMAGE: fairodds-value-bet-concept-diagram.png ]

The Math Behind Value Betting

Implied Probability

Every set of odds implies a probability. The formula is:

Implied Probability = 1 / Decimal Odds × 100Examples:

- Odds 2.00 → 1/2.00 = 50%

- Odds 1.50 → 1/1.50 = 66.7%

- Odds 3.00 → 1/3.00 = 33.3%

Expected Value (EV)

Expected Value tells you how much you'll win or lose on average per bet.

EV = (Probability × Profit) - (1 - Probability) × StakeOr more simply:

EV% = (Your Odds / True Odds - 1) × 100Example:

- True probability: 50% (true odds = 2.00)

- Bookmaker offers: 2.10

- EV% = (2.10 / 2.00 - 1) × 100 = 5%

This means for every $100 bet, you expect to profit $5 on average.

[ IMAGE: fairodds-ev-calculation-example.png ]

Why Value Betting Works

The Casino Analogy

Casinos don't win every hand of blackjack. But they have a small edge on every bet. Over millions of hands, that edge compounds into guaranteed profit.

Value betting is the same concept, but in reverse:

- You have the edge

- The bookmaker is at a disadvantage

- Over time, your edge compounds into profit

The Law of Large Numbers

Individual bets are unpredictable. But over hundreds or thousands of bets, results converge toward expected value.

| Number of Bets | Variance | Results |

|---|---|---|

| 10 | Very high | Anything can happen |

| 100 | High | Patterns emerge |

| 1,000 | Moderate | Close to expected |

| 10,000 | Low | Reliable profit |

[ IMAGE: fairodds-law-of-large-numbers-chart.png ]

How to Find Value Bets

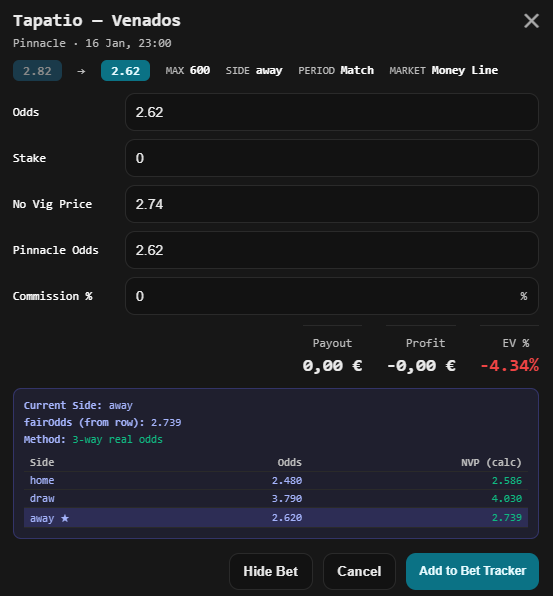

Method 1: Sharp Bookmaker Comparison

The most reliable method is comparing odds to sharp bookmakers like Pinnacle.

Why Pinnacle?

- Accepts sharp action (winning bettors)

- Lowest margins in the industry

- Odds reflect true market probability

The process:

- Pinnacle's odds move based on sharp money

- Calculate the No Vig Price (NVP) from Pinnacle

- Compare NVP to soft bookmaker odds

- If soft odds > NVP → Value bet

[ IMAGE: fairodds-sharp-vs-soft-bookmaker-comparison.png ]

Method 2: Dropping Odds Strategy

When Pinnacle's odds drop rapidly, it signals sharp money entering the market.

Soft bookmakers don't react immediately, creating a window where their odds are too high.

This is exactly what Fair Odds Terminal monitors for you.

The No Vig Price (NVP)

What is Vig?

"Vig" (or vigorish) is the bookmaker's margin built into the odds.

Example:

- Fair odds for a coin flip: 2.00 / 2.00

- Bookmaker's odds: 1.91 / 1.91

- The difference is the vig (~5%)

Calculating NVP

The No Vig Price removes the bookmaker's margin to show the "true" odds.

Fair Odds Terminal calculates this automatically using Pinnacle's odds.

Example:

- Pinnacle odds: 1.85 / 2.05

- After removing vig → NVP: 1.92 / 2.08

- These are the prices you need to beat

Value Bet Example

The Setup

Match: Team A vs Team B

Market: Moneyline — Team A

| Source | Odds |

|---|---|

| Pinnacle | 1.85 |

| NVP (after devig) | 1.92 |

| Bet365 | 2.05 |

The Analysis

EV% = (Bet365 Odds / NVP - 1) × 100

EV% = (2.05 / 1.92 - 1) × 100

EV% = 6.77%This is a value bet. Bet365 is offering 2.05 when the true price is 1.92.

The Outcome

Whether you win or lose this specific bet doesn't matter. What matters:

- You placed a bet with positive expected value

- Over time, these bets compound into profit

Common Misconceptions

"I need to win to profit"

Wrong. You need positive EV to profit long-term. You'll lose many individual bets but come out ahead.

"Favorites are safer"

Wrong. What matters is whether the odds represent value, not whether the team is favored.

"Big odds mean big value"

Wrong. Value is about the relationship between offered odds and true probability, not the size of the odds.

"I can feel when a bet is value"

Wrong. Value is mathematical, not intuitive. You need data to calculate it objectively.

Value Betting with Fair Odds Terminal

Fair Odds Terminal automates the hard parts:

- Monitors Pinnacle odds — Tracks drops in real-time (↓ DROPS tab)

- Browse all events — View any Pinnacle event and open charts (☰ ALL tab)

- Calculates NVP — Removes the vig automatically using Power Method

- Odds history charts — Click any row to see full price history

- Sound alerts — Optional audio notification when new drops appear

Your job is to:

- Configure your filters

- Verify the value still exists

- Execute the bet

- Track your results

[ IMAGE: fairodds-value-betting-workflow.png ]

Getting Started

1. Set Realistic Expectations

- Expect variance (winning and losing streaks)

- Think in terms of hundreds of bets, not individual results

- Typical ROI: 2-5% on turnover

2. Start Small

- Use small stakes while learning

- Scale up as you gain confidence and verify results

3. Track Everything

- Log every bet in Bet Tracker

- Review results weekly/monthly

- Adjust strategy based on data

4. Stay Disciplined

- Only bet when EV is positive

- Don't chase losses

- Don't deviate from your strategy

Summary

Value betting is:

- Betting when odds are higher than true probability

- A mathematical edge, not gambling

- Profitable over the long term

To find value bets:

- Use sharp bookmaker odds as your benchmark

- Calculate the No Vig Price (NVP)

- Bet when soft bookmakers offer odds above NVP

- Track results and stay disciplined

Fair Odds Terminal helps by:

• Monitoring Pinnacle odds drops in real-time (↓ DROPS tab)

• Browsing all Pinnacle events and opening charts (☰ ALL tab)

• Calculating NVP automatically using Power Method

• Showing full odds history charts for each selection

• Optional sound alerts when new drops appear